We all have investments – but not everyone knows where they are and how they are used

How is money invested in Austria?

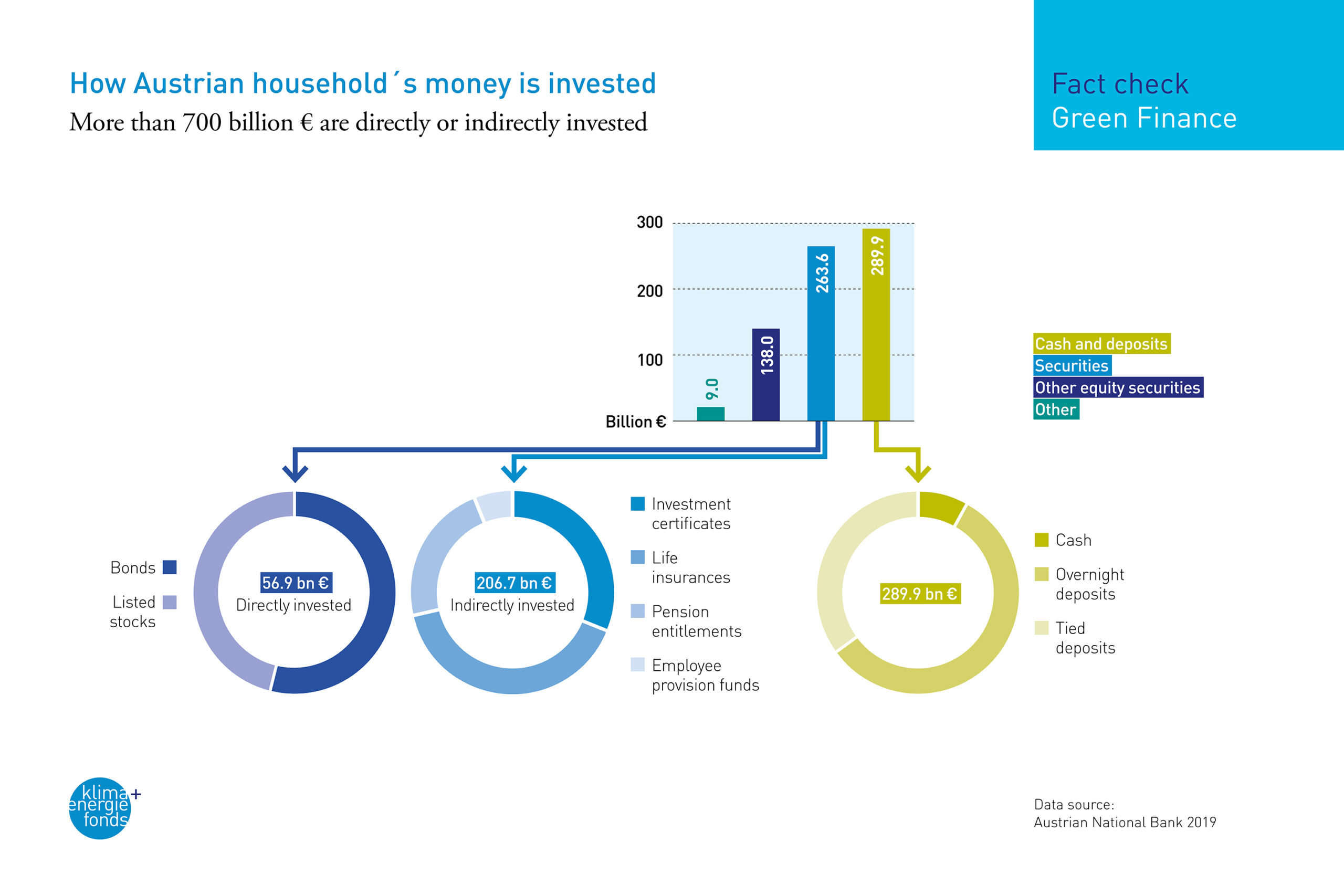

According to the Austrian National Bank, as of June 2019 Austrians’ total financial wealth is 715 billion euros. Whether the money is held at the bank, in life insurance, investment funds or occupational benefits, unless it’s being stored under the mattress, it’s being invested – mostly to finance private or public companies. The share of flexible and risk-free investments held in the form of cash (€23.9 billion) and overnight deposits (€165.3 billion) accounted for around one quarter of total financial assets in mid-2019. Investments in securities (bonds, listed stocks) are made directly by individual households, but to a much higher extent indirectly, via life insurance, pension entitlements, provision funds or investment certificates. 142 billion euros in pension schemes made up one fifth of the total financial assets. Institutional investors increasingly regard investing in sustainable projects and new business models as a chance to reduce risks and adhere to ethical principles. In future, banking and financial advisors should spend more time informing their clients about climate-related risks.

It is also true that investing in the real economy offers an important option for private individuals to invest their money in climate protection: by installing a photovoltaic system on their own roof, or buying shares in a citizen’s power plant, or replacing their car with an e-vehicle. Private investments offer huge potential for contributing to the switch to a climate-friendly energy system.