Climate change as a financial risk – climate protection as an investment opportunity

To what extent is climate change also a risk for investors?

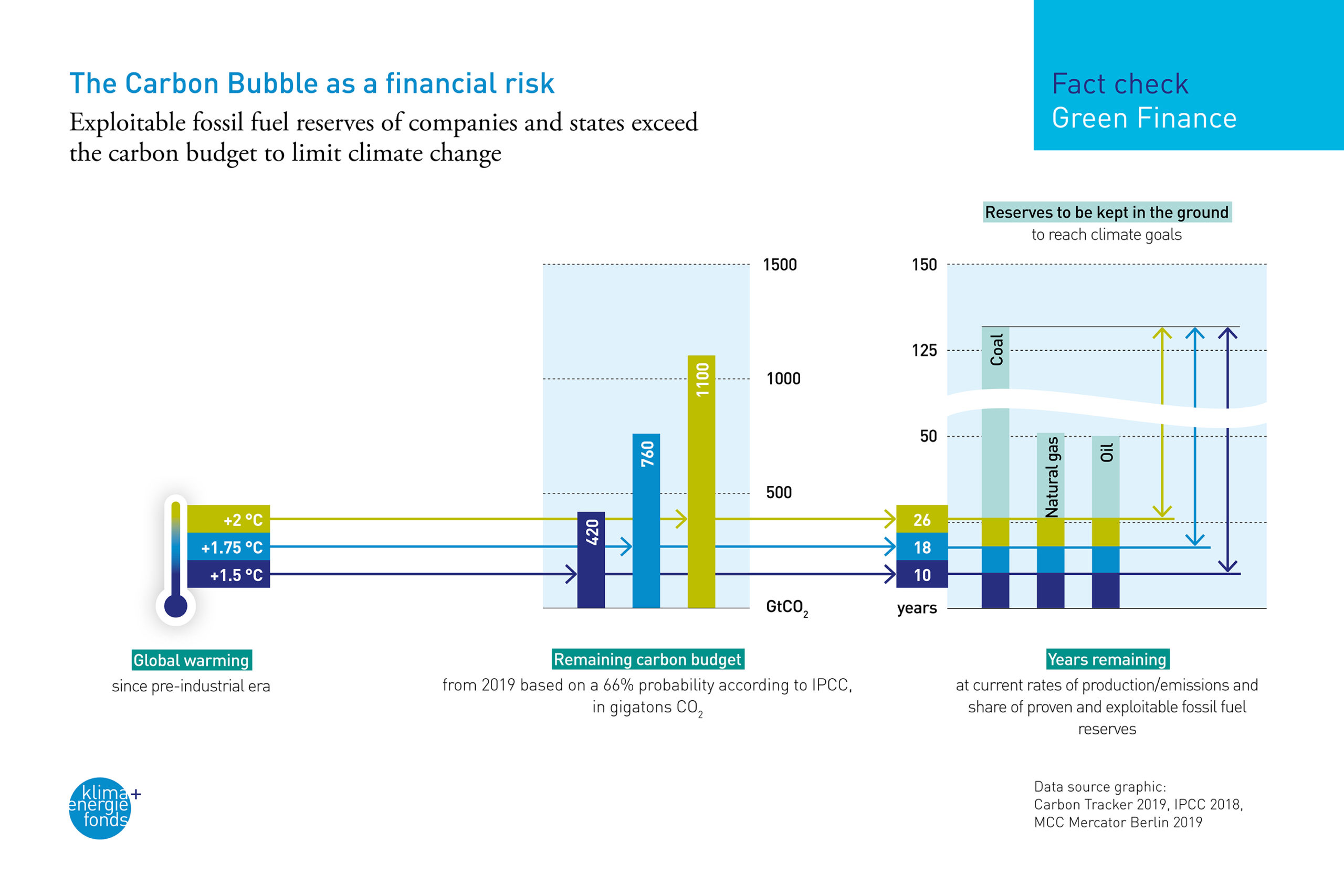

Climate change has dramatic consequences for the economy, and also poses a threat to global finance. On the one hand, more floods, drought, heat and storms can cause massive damage which impacts production and delivery chains. On the other, a climate-friendly energy system results in a decrease in demand for coal, oil and gas, and thus a loss in value for these assets and capital invested in them. In total almost 2,000 billion euros are potentially threatened – including funds invested in these companies. The Carbon Bubble refers to the potential over-rating of companies largely dependent on fossil fuels, such as those active in the oil, gas and coal industries. If the temperature increase is to remain below 2°C (as of 2018), a maximum of only 1,110 gigatons of CO2 may be released into the atmosphere by 2050. To keep the temperature increase below 1.5°C, this limit is reduced to 400 gigatons CO2 at most. The emissions generated by using the known reserves of extractable coal, oil and gas would exceed this remaining CO2 budget many times over. Consequently, adhering to the climate goals severely limits the use of these resources, making investment in this field risky.

At the same time, investments in climate protection represent a huge opportunity because new business models, climate-friendly technologies and sustainable infrastructure will all be in greater demand. Newly designed energy, mobility and agricultural systems will bring opportunities for new technologies, projects, players, and service providers.