Everyone can join in and be active

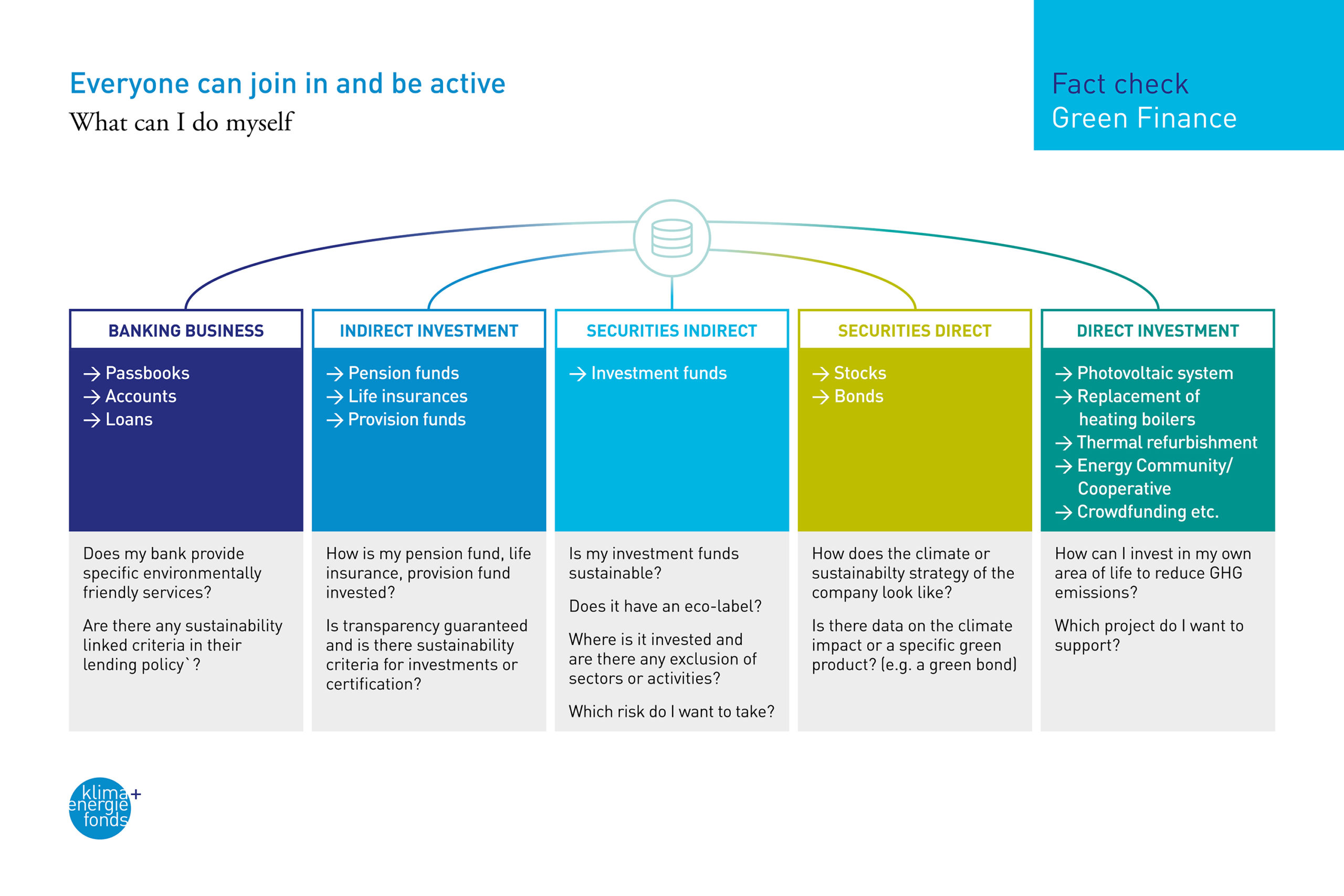

What can I do myself?

Not only institutional investors, but also private individuals can contribute to climate-friendly investments. The first important step is to examine one’s own financial assets and ask the bank/insurance advisor/capital investment company where your money is invested. Do your investments accelerate climate change or are they climate-friendly? To what extent do these investments take other sustainability criteria into account?

A recent assessment of Austrian retail banks conducted by WWF has concluded that there is room for improvement at all banks. Not only bonds, but also bank lending, shares, and the general orientation of banks/insurance companies/pension funds are factors. It is about considering which loans or investments are associated with an individual deposit or premium.

In almost all cases it is possible to make changes, or to demand change and reallocate one’s own financial assets. Whether directed at banks, insurance companies, capital investment companies, or consumer companies, the very fact of enquiring about one’s own financial situation already has an impact. Quality marks and certificates help provide orientation. The Austrian Ecolabel for Sustainable Financial Products (UZ 49), one of the first labels in this field, has been in existence since 2004. It regularly updates and develops its criteria.