New rules will make the financial market more sustainable

Is it possible to simply order more sustainability in financial investment?

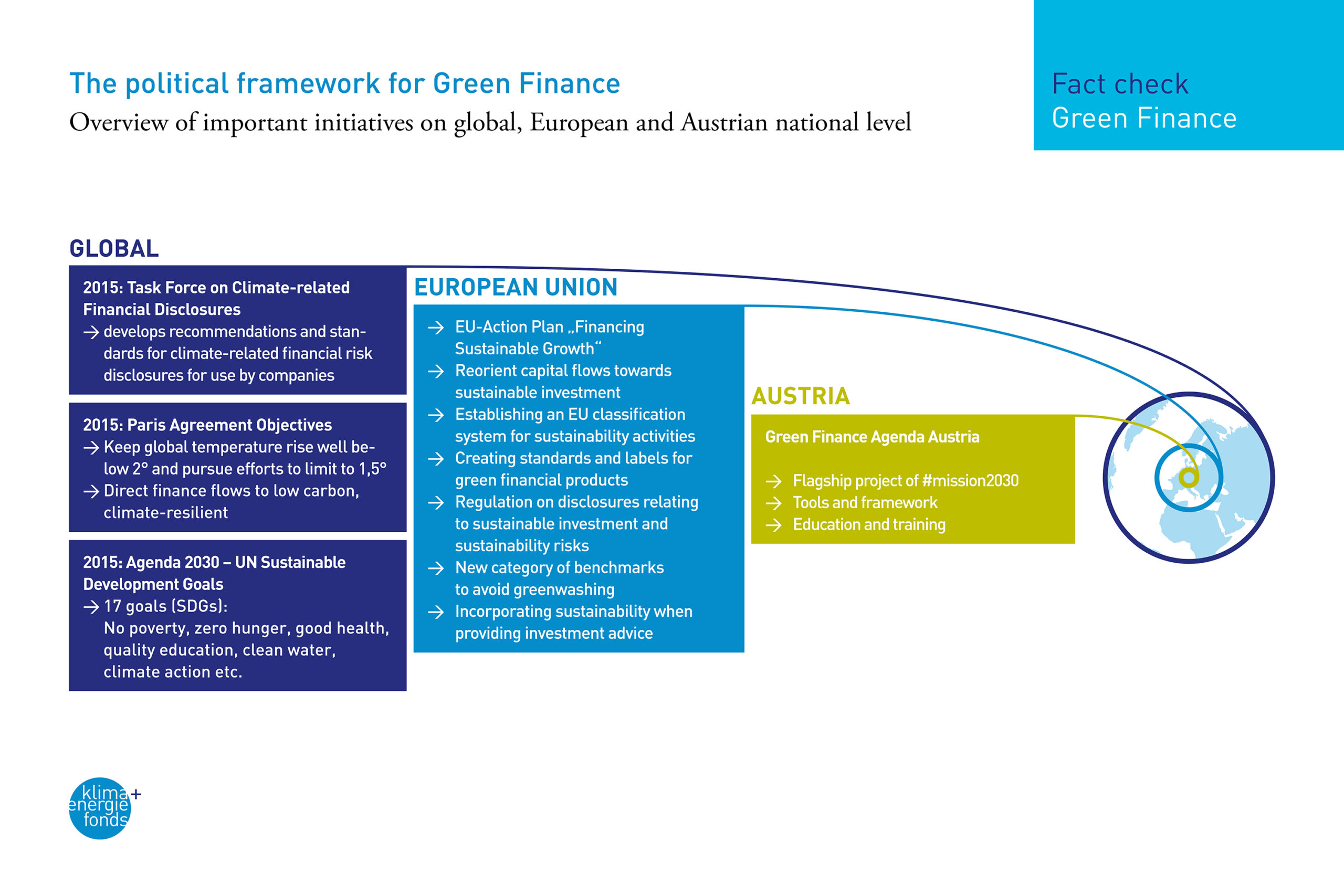

Not only did the topics of climate change and sustainability start impacting the market long ago, the rules of the financial markets will continue to change. The role of Green Finance will be reflected in new strategies and regulations at Austrian, European, and international level. The key goals are to enhance transparency, reflect the risks, and redirect financial flows into climate-friendly activities. The EU action plan on financing sustainable growth is a central element which should serve to create a common understanding of what is seen as sustainable. Key elements, amongst others, are the definition of a uniform EU classification system for the sustainable financial system (taxonomy), and designing an EU label for “green” financial products. Moreover, relevant regulatory developments designed to integrate sustainability into the supervisory duties are also planned.

However, climate goals cannot be achieved through Green Finance alone. Success will go hand-in-hand with ambitious strategies, suitable framework conditions, and initiatives in all energy-related economic sectors. Austria´s government and administration is also actively addressing the issue of Green Finance. The “Green Finance Agenda” is a project for the implementation of Austria‘s climate and energy strategy #mission2030. It is designed to create suitable framework conditions and tools to mobilize the private capital needed to solve society’s challenges, and to increasingly direct public funds into sustainable investment. In a global comparison, Austria currently ranks amongst the best in many country sustainability ratings.