Increased Demand for Green Finance

Does sustainability have a role in the financial system?

Sustainable, or green, investments are available in different forms. They only differ from conventional types of investment by supplementing the classic financial criteria with ecological, social and ethical assessments. The focus is increasingly shifting to climate protection. The volume of funds invested in line with sustainability criteria has increased heavily in recent times. The criteria themselves, however, can differ significantly, and therefore it is important to examine the orientation of the respective financial product carefully.

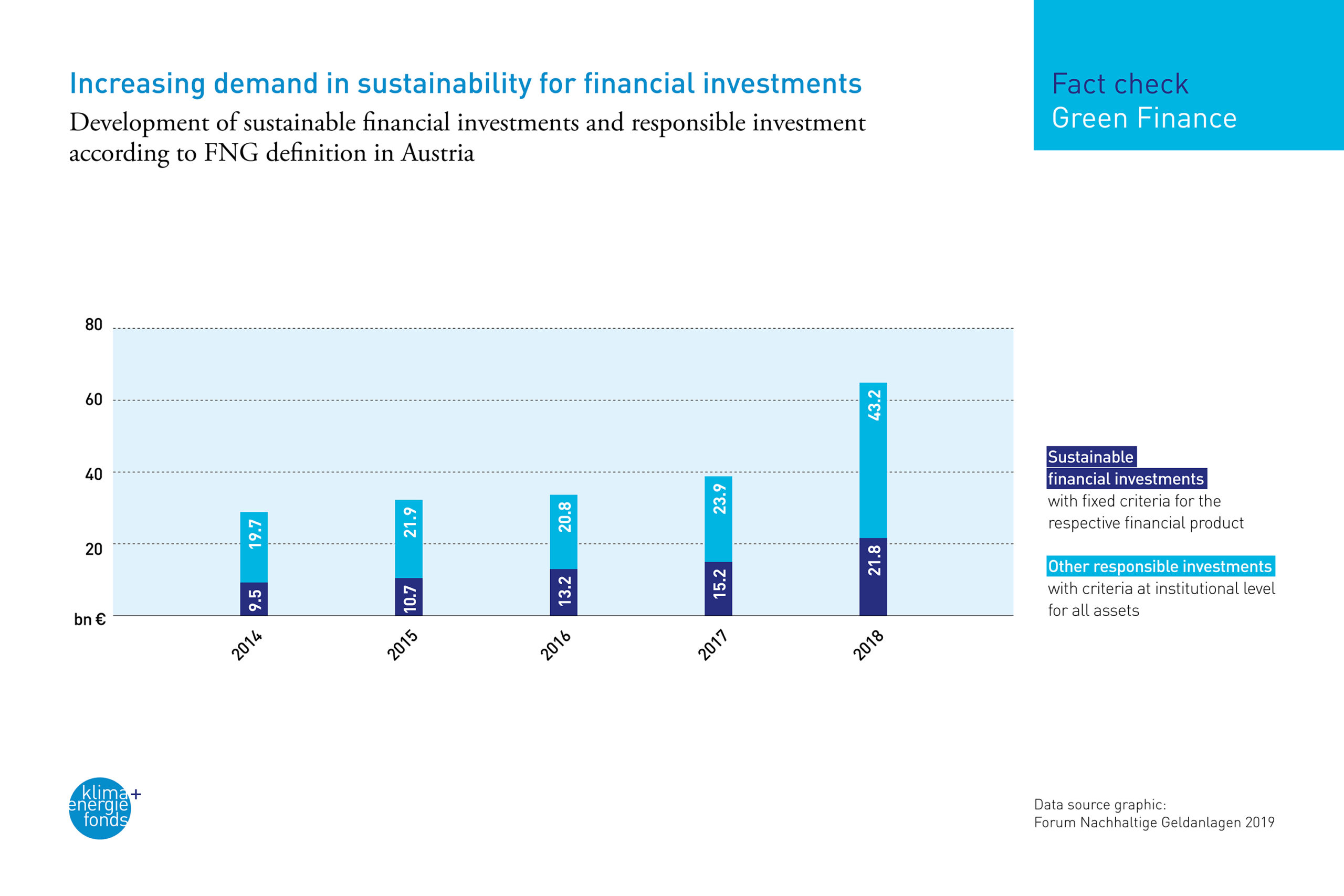

The annual market report published by the Forum für Nachhaltige Geldanlagen (Forum for Sustainable Investments) provides an overview of the most recent market developments in Germany, Switzerland and Austria. The FNG methodologically distinguishes between so-called “responsible investments” and “sustainable investments”. In contrast to the sustainable financial investments which follow sustainable investment strategies and criteria defined and determined in writing at product level, in the case of responsible investments sustainable investment criteria and strategies are defined at corporate/institutional level. In Austria the sum of sustainable investment reached a new high in 2018, at 21.8 billion euros. The volume of responsible investments reached 65 billion euros, also having strongly increased again.

In the energy and climate protection sector, alternative forms of financing, such as crowd financing, are offering ever more options. These allow projects to be financed by a large number of smaller investors.