Incorporating sustainability – realizing climate protection

How can I find out whether an investment is green or sustainable?

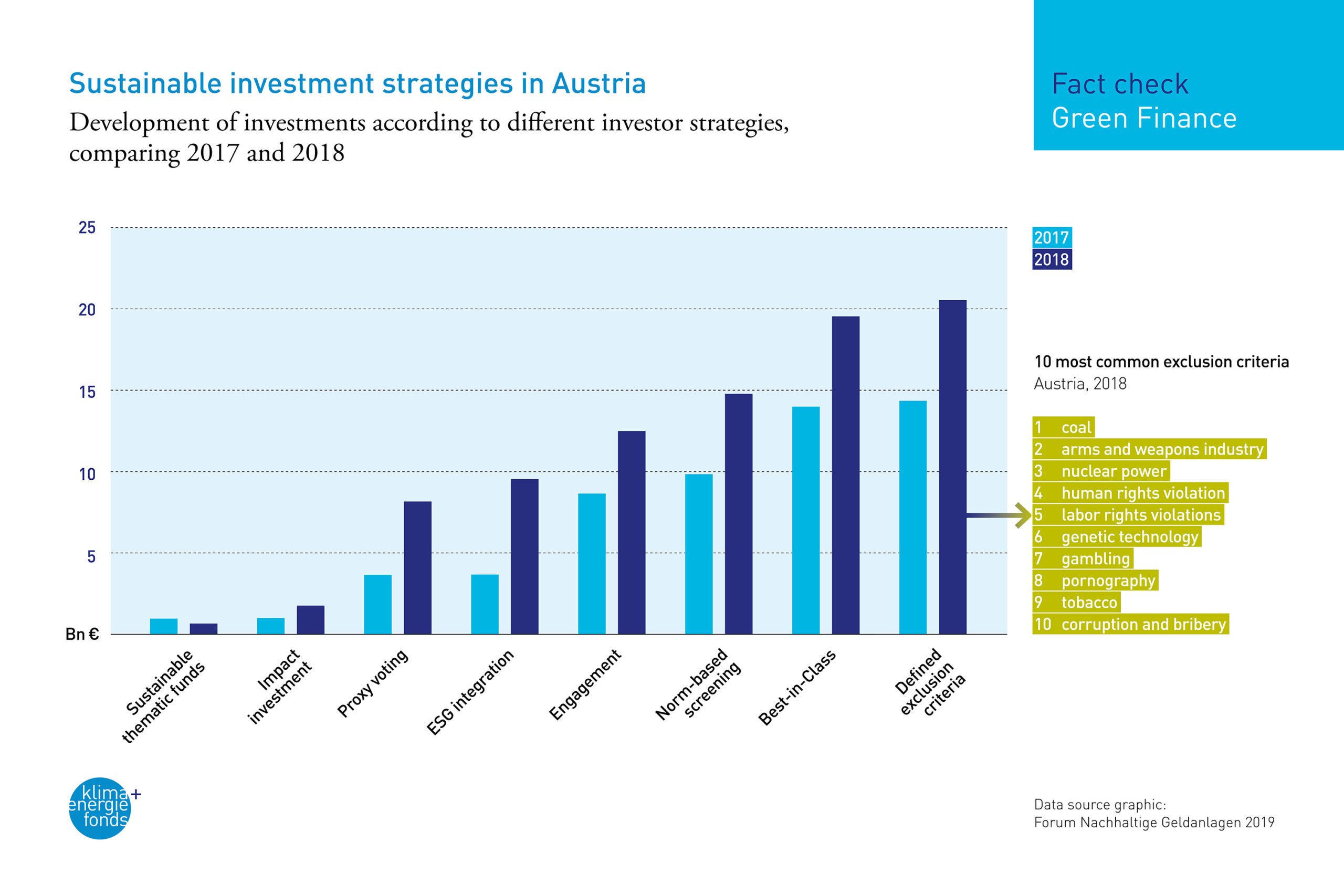

It’s not easy for private individuals to discover what is covered by a specific investment. Not only are there a wide range of types of sustainable investment, but there are also many differing strategies and methods for realizing them. One thing is clear: sustainable financial investments are always tied to a certain set of criteria, although their definitions and measurements vary. ESG criteria, best-in-class or the exclusion of entire industries: when applying sustainability methods, the investor has to ask what is really included in the portfolio or investment, and which sectors are covered. Creditability will be key when introducing a sustainable financial product.

The key term for many sustainability assessment methods is ESG: Environmental – Social – Governance. This term has been established for many years, indicating whether and to what extent corporate governance takes into account ecological and social considerations. Many investors have integrated ESG criteria into their bond analyses. Exclusion criteria serve to exempt certain industries, companies or states from the investment universe, either because they act in a climate-damaging manner (e.g. make money in coal mining), fail to fulfill social criteria (violation of human rights or accepting child labor), or are ethically inacceptable (e.g. due to arms deals). The Austrian environmental label for financial products (UZ 49), which is widely used in Austria, has also clearly defined minimum exclusion criteria, ranging from nuclear power, coal companies or companies and institutions which systematically violate human and labor rights, as well as key political, social or environmental standards, etc. In certain fields some tolerance is defined through threshold levels.